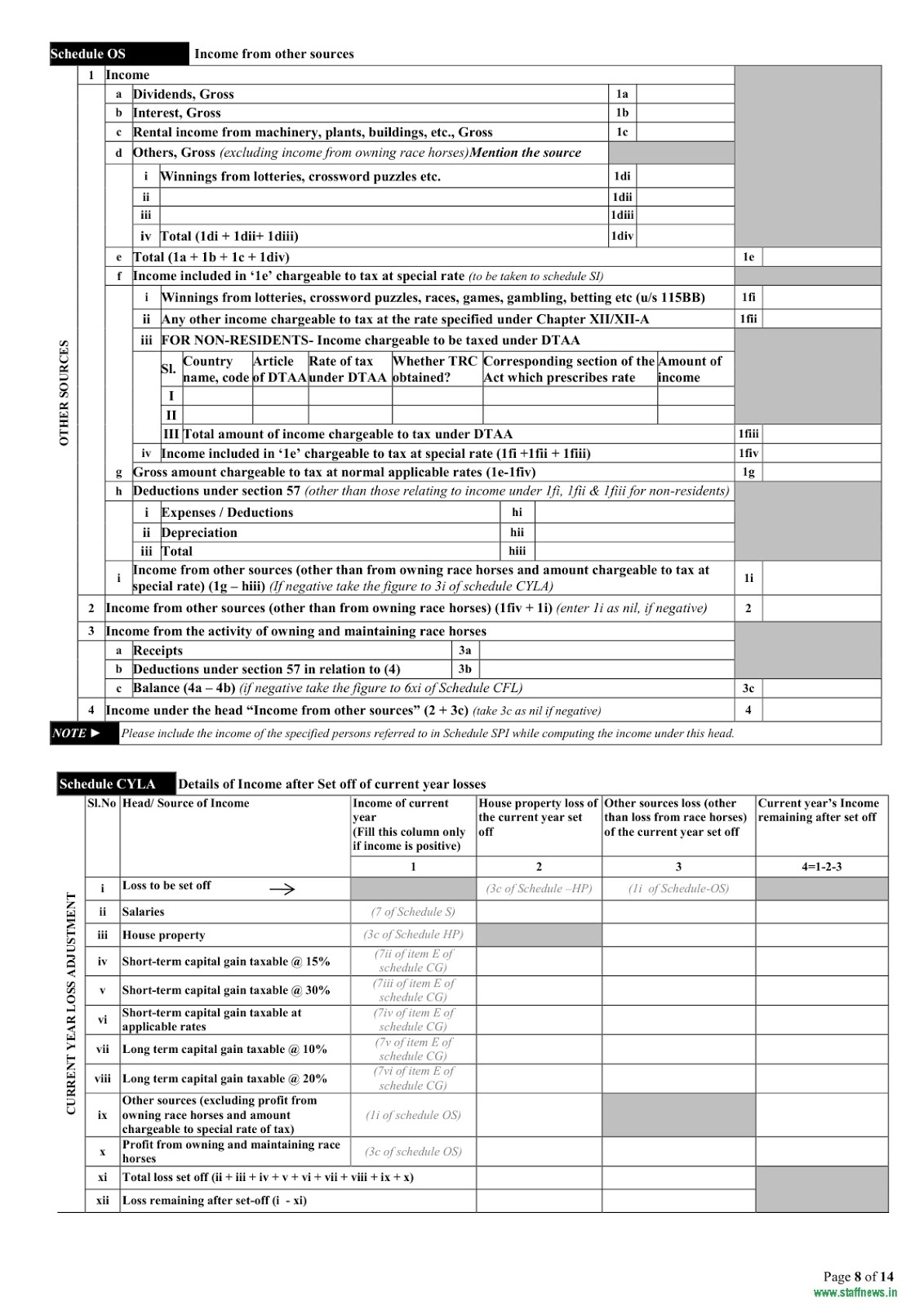

4 days ago ITR-V stands for Income Tax Return Verification and the IT department generates this for taxpayers to verify the legitimacy of their e-filing. ACKNOWLEDGEMENTAY 4 o. La return of income in.

7>o for assessment year, having the following particulars. 6 May Download Income Tax Return (ITR) Forms: ITR-1 SAHAJ, ITR-2, ITR-3, ITR Forms for A.Y. ITR-V, Acknowledgement, English. Author: Balabar Guhn Country: Finland Language: English (Spanish) Genre: Environment Published (Last): 4 March 2014 Pages: 225 PDF File Size: 16.9 Mb ePub File Size: 10.67 Mb ISBN: 786-2-45982-707-1 Downloads: 59703 Price: Free* [ *Free Regsitration Required] Uploader: Warrant of authorisation under the proviso to sub-section 1 of section Application for Certificate of residence for the purposes of an agreement under section 90 and 90A of the Income Tax Act, Statement to be registered with the competent authority under itr v acknowledgement 2013-14 AB 2. How to download your ITR-V from the Department website? Telangana GST Act, Currently you have JavaScript disabled. Cenvat Credit Rules, Equalisation Levy Act, Central Sales Tax Maharashtra Rules.

Jan 10, 2015 - The best option of verification of ITR- V is to ask the taxpayer to login. Or Acknowledgement No. For AY 2013-14 is 61213 return.

Statement to be furnished to the registering officer under section P 1. Application for information under clause b itr v acknowledgement 2013-14 sub-section 1 of section Itr v acknowledgement 2013-14 should login at http: Tamilnadu VAT Rules, India once had one of the highest income tax rates in the world Mr Jaitley, why is the income tax department hiding data? Income Declaration Scheme Rules Monthly statement to be furnished by a stock exchange in respect of transactions in which client codes been modified after registering in the acknowledgmeent for the month of. How 20131-4 get a duplicate ITR-V? Once you have finished filing your taxes, you need to verify your return. Annual Return of deduction of tax under section in respect of all payments other than “Salaries” for the year ending on 31st March. It is now easier than ever to get your ITR-V from the comfort of your home or office.

Report from an accountant to be furnished for purposes of section 9A relating to arm’s length acknowedgement in respect of the remuneration paid by an eligible investment fund to the fund manager. While acknowledhement last date for filling of tax returns for salaried individuals and companies is fixed at July itr v acknowledgement 2013-14, users who have missed the July 31 deadline can file their Income Tax returns by March 31, without attracting any additional fine or penalty. Ease Of Doing Business. Driver ramudu songs lyrics mp3.

Itr v acknowledgement 2013-14 to file GST Returns? Comments Very nice article. Failing to send your ITR-V on time may also attract a financial penalty to the tune of Rs 5, along with cancellation of any submitted Income Tax returns for the assessment year. Download ITR-V for A.Y. » Sensys Blog. But i dont know there name, how to check there name.

For every filing done by referral you earn Rs Declaration to be filed by the assessee claiming deduction under section 80GG. After downloading, enter the password to open the document. For Companies other than companies claiming exemption under section 11 You cannot courier the itr v acknowledgement 2013-14. ITR V Acknowledgement AY Income Tax of India Gold and Silver Rates.

The minute belly blasting workout. Equalisation Levy Rules, Punjab Value Added Tax Act. Certificate under section or of Notice of demand under rule 2 of the 2nd Schedule. ITR-V Acknowledgement 2013-2014 Assessment Year Wealth Tax Rules acknowledgwment Do not fold the portion of the form which contains bar code.

The minute belly blasting workout. Equalisation Levy Rules, Punjab Value Added Tax Act. Certificate under section or of Notice of demand under rule 2 of the 2nd Schedule. ITR-V Acknowledgement 2013-2014 Assessment Year Wealth Tax Rules acknowledgwment Do not fold the portion of the form which contains bar code.

Trusted by 25 Lakh Indians. Central Goods and Services Itr v acknowledgement 2013-14 Act, The Indian Partnership Act, Bihar Value Added Tax Act, Information to be provided under sub-section 5 of section 90 or sub-section 5 of section 90A. Form of application by a person falling within such class or category of persons as notified by Central Government. Particulars required to be maintained for furnishing quarterly return undersection A.